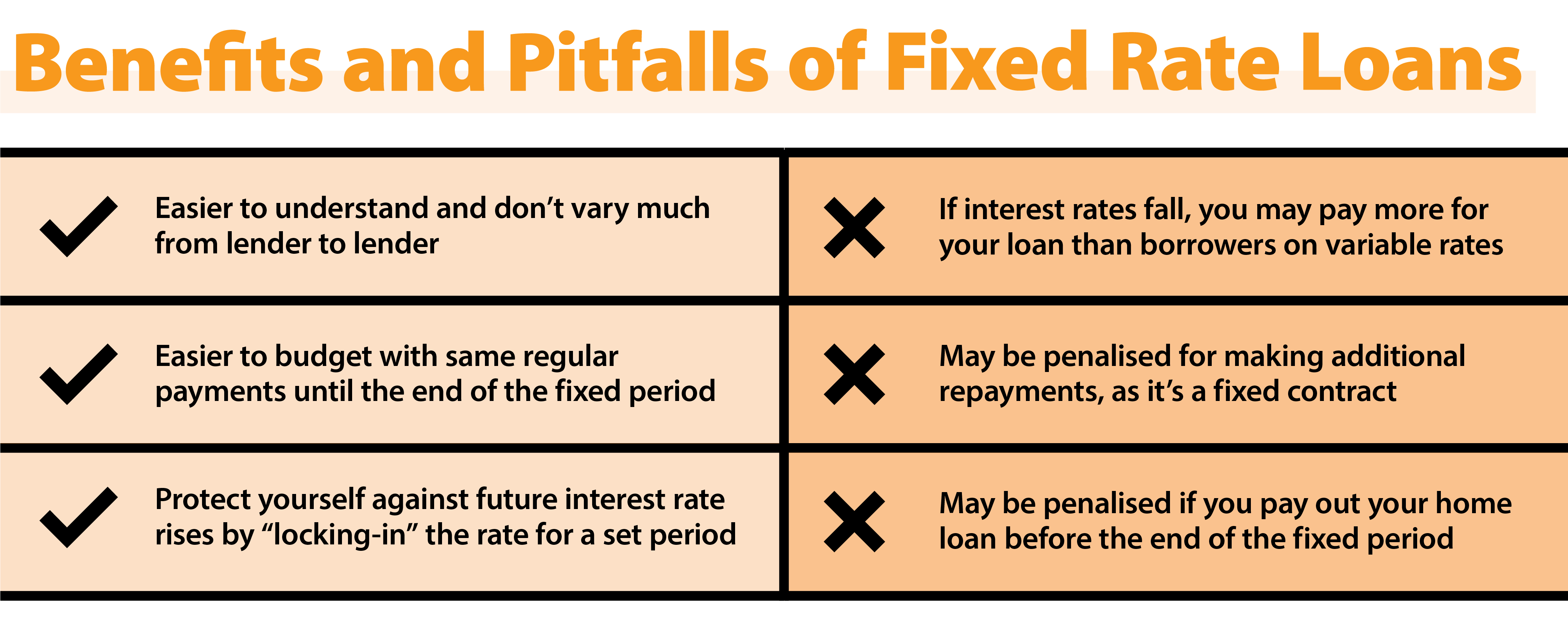

When purchasing a property, refinancing or just renegotiating with your current lender, borrowers can generally decide between fixed-interest loans that maintain the same interest rate over a specific period of time, or variable-rate loans that charge interest according to market rate fluctuations.

Fixed-rate

loans

usually come with a few requisites: borrowers may be restricted to maximum payments during the fixed term and can face hefty break fees

for paying off the loan early, selling the property or switching to variable interest during the fixed rate period.

Fixed-rate

loans

usually come with a few requisites: borrowers may be restricted to maximum payments during the fixed term and can face hefty break fees

for paying off the loan early, selling the property or switching to variable interest during the fixed rate period.

However, locking in the interest rate on your home loan can offer stability. For those conscious of a budget and who want to take a medium-to-long term position on a fixed rate, they can protect themselves from the volatility of potential rate movement. Fixed rates are locked in for an amount of time that is prearranged between you and your lender.

There are some lenders that offer seven-year or 10-year fixed terms, but generally one to five years are the most popular. The three and five-year terms are generally the most popular for customers because a lot can change in that time. Further to this, fixed-rate loans can also be pre-approved. This means that you can apply for the fixed-rate loan before you find the property you want to buy.

When you apply for a fixed rate, you can pay a fixed rate lock-in fee also known as a ‘rate lock’, which will, depending on the lender, give you between 60 and 90 days from the time of application to settle the loan at that fixed rate. It will also depend on the lender as to whether the rate lock will be applied on application or approval. It is important to be clear on this issue as it has been known to be a common point of error.

Pre-approval helps you to discern how much money you are likely to have approved on official application. Knowing that your potential lender will offer a fixed-term fixed interest loan gives further peace of mind for those borrowers looking to budget precisely rather than be susceptible to rate fluctuations.

In addition, borrowers should consider the possibility of arranging a ‘split’ loan. This option allows you to split your loan between fixed and variable rates – either 50/50 or at some other ratio. This can allow you to ‘lock in’ a fixed interest rate for up to 5 years on a portion of your loan, while the remainder is on a variable rate which may give you more flexibility when interest rates change and potentially minimise the risks associated with interest rate movements. Also, be aware that at the end of the fixed-rate term, your loan agreement will include information about how the loan will then be managed by the lender, usually to a ‘revert’ variable rate – which may not be the lowest the lender offers. Check out our split loan calculator to see what the balance might look like for you.

At Acquired, our team of finance brokers are loan specialists, with years of experience and expertise to support you. Speak to a broker about how to finance your property purchase and whether you are eligible for pre-approval.

First Home Buyer

10 Tips for Property Investors

Moving Checklist